Greetings fellow book enthusiasts! Today, we gather to unravel the pages of Repo Madness: A Simpleton’s Guide to the Street’s Wicked Ways by M.E. Tuthill. As avid readers, we know that a good book isn’t just a story—it’s an odyssey. With Repo Madness, we follow the breadcrumbs of knowledge that Tuthill lays out before us. From the captivating narrative to the eye-opening revelations, this book provides us with an opportunity to not only delve into the complexities of shadow banking but to also question and reflect on the systems that underpin our economic reality. Join us as we dissect this literary voyage with a reader, sharing perspectives and insights.

What initially intrigued you about Repo Madness: A Simpleton’s Guide to the Street’s Wicked Ways?

I am still steamed about the financial crisis and deeply suspicious about Wall Street. My initial impression was I might learn something new.

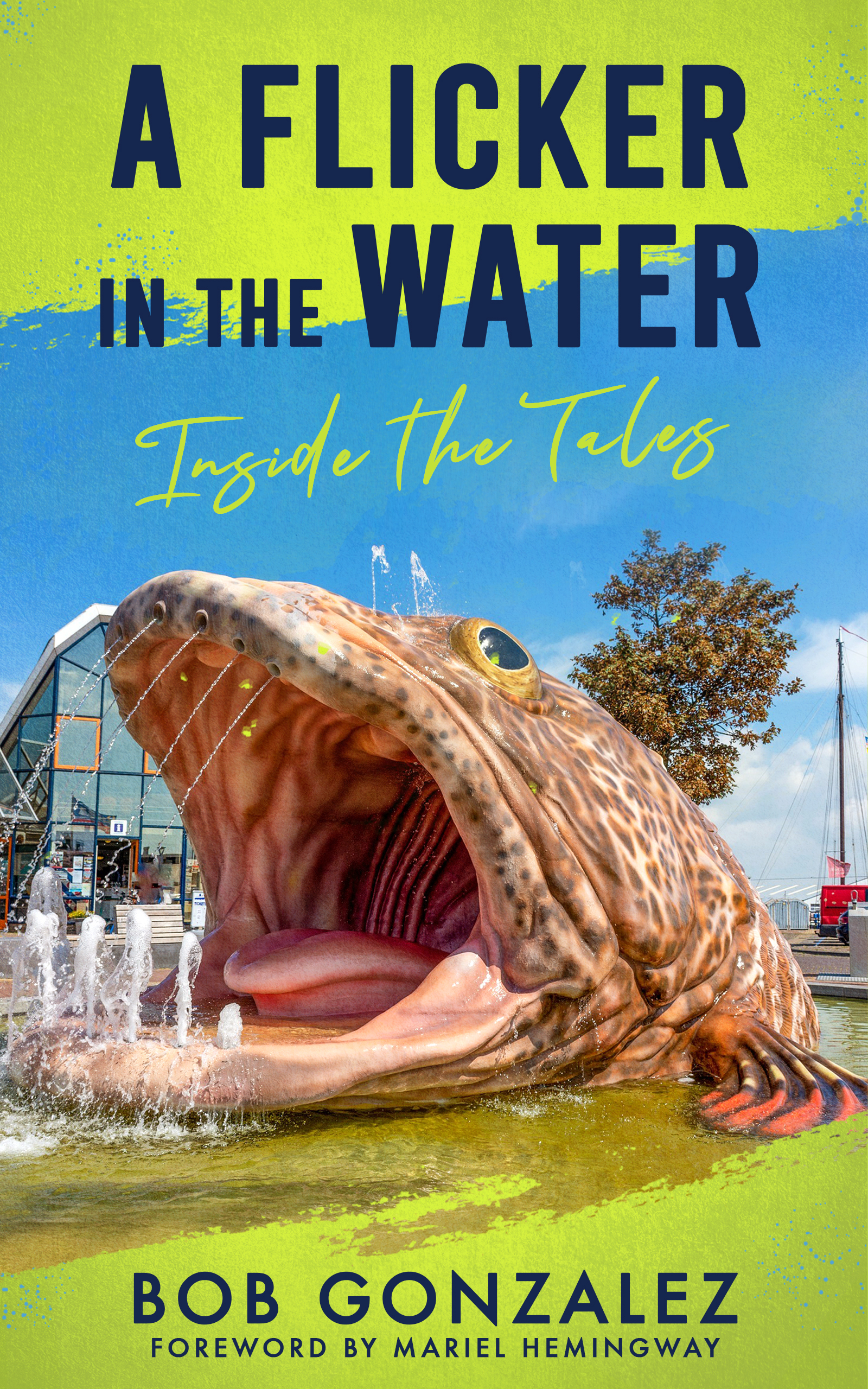

Did the title or subject matter catch your attention, or was it something else?

Actually, it was the picture on the cover. So long we have heard about shadow banking without a real understanding of what it is. The picture showed it in such a way as to allow one to think someone, the author, could actually break it down for the average person.

How would you describe the author’s writing style in Repo Madness? Did you find it engaging and accessible, considering the complex topic of repossession?

First, it is not about repossession but repurchase agreements-two very different things. At times I had trouble with the terminology and had to look up online for clearer explanations, but it didn’t deter me and was a minor issue. As for engaging, well, yes. The author was very engaging in that she wrote about it from the reader’s perspective. In other words, she was not defending the status quo but in fact shattering it.

Were you familiar with this topic before reading the book? What new information or perspectives did you gain from the author’s exploration?

I was not familiar with repurchase agreements and was astonished at what a huge role they play in our financial lives. Practically every page contained new information and the book left lots of room for further exploration of the topics discussed.

What did you think about the balance between storytelling and educational content in the book? Did the author effectively weave personal anecdotes and experiences with practical information about repossession?

In the beginning she shared an anecdote. What I liked about it was that while there were few anecdotes there were many instances where she shared her insights, feelings, and opinions—sometimes laced with dark humor. It made it relatable.

Were there any specific stories or examples in Repo Madness that stood out to you? How did they contribute to your understanding of the subject matter?

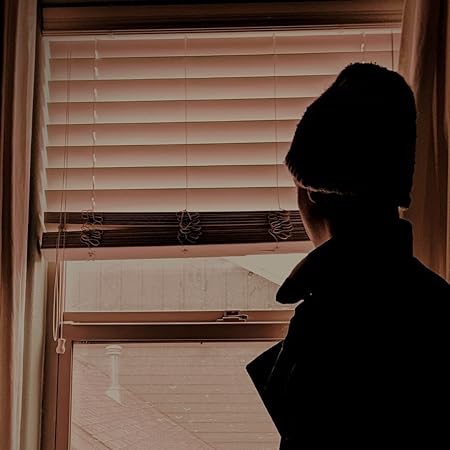

I think what stood out the most was the clarity with which she presented her case that all of this is beyond detrimental to the citizenry. That we are purposefully being kept in the dark when it comes to a system that informs each one of our lives and not in a good way.

In Repo Madness, the author refers to it as a Simpleton’s Guide. Do you think the book achieved its goal of making a complex topic accessible to readers with little prior knowledge? Why or why not?

Did Repo Madness challenge any preconceptions or assumptions you had about the financial industry in general? If so, how did your perspective shift?

Again, the book is about repurchase agreements and because I knew nothing about them, I had no preconceptions or assumptions except to say it confirmed my suspicions about Wall Street that were born of the financial crisis. Like most Americans, I suffered during that time and was and am angry about what happened. Now, I know it is still happening and we could have another crisis.

Were there any moments in the book where you found yourself disagreeing with the author’s viewpoints or arguments? How did you reconcile those differences, and did they affect your overall appreciation of the book?

No. I found her reasoning to be rational and in line with my own. I agreed with her about the special treatment of the banks and how corroding it is. Just to name one example.

What lessons or insights did you personally take away from Repo Madness? Did the book offer any practical advice or suggestions that you found valuable or thought-provoking?

I came away with utter amazement at what goes on that we, the general public, are not aware of. Here is a multi-trillion market that operates in virtually every corner of the world and no one knows about it.

Considering the broader themes explored in Repo Madness, such as finance, personal responsibility, and societal impacts, do you think this book would appeal to a wide range of readers? Why or why not?

What is most compelling about this book is that it shows how nothing can change until we know what needs changing. Simply put, before I read this book, I had no idea of how the shadow banking system operated. Did not know how destructive it has been–how can one fix something when it is purposefully hidden from public view? An economics professor did not know about it!! How bad is that!! This book not only shares scarce information but also tells us we are not the crazy ones. Now that we know—we can share with others especially lawmakers!